Table of Content

- SBI Pradhan Mantri Awas Yojana – Interest Rates 2022, Eligibility, Apply Online

- SBI PMAY Home Loan Eligibility and Guidelines for EWS & LIG

- Government Schemes

- Revised Credit Linked Subsidy Scheme – EWS/LIG

- Home Loan Subsidy by the Government

- SBI PM Awas Yojana Subsidy Status 2022

- SBI – PMAY (Pradhan Mantri Home Loan) Scheme

However, repairing work can be undertaken only in kutcha and semi-pucca houses. In case it is a semi-pucca house the benefit can be availed only if extensive renovation needs to be carried out to make it a pucca house. Can I avail the subsidy if I purchase a newly constructed house that is being resold? Yes, you can avail the subsidy as under the definition of a new construction, the resale of a new construction house is included.

This consent will override any registration for DND/NDNC/NCPR. Explore your dream house from a bouquet of exclusive products designed for each customer segment. A married pair may be eligible for a single dwelling owned by either one of them or both of them jointly, depending on the income of the family. Your personal mortgage expert will support you to review and understand all your options. Our custom optimization engine and expert advisors will help you make the optimal decision for your personal circumstances. Banks in Germany like safety and are interested in you paying back the mortgage.

SBI Pradhan Mantri Awas Yojana – Interest Rates 2022, Eligibility, Apply Online

In case the applicant had applied for the home loan scheme and switches to another bank, then in that case he/she cannot avail the benefits of interest subvention. There are a total of about cities and towns across the country where the benefits of PMAY home loan scheme can be availed. The PMAY list of cities can be downloaded directly from the link from the SBI website. Any delay or failure of this kind will not be deemed to be a breach of the Terms of Service (Terms & Conditions) and the time for performance of the af-fected obligation will be extended by a period which is reasonable in the circumstances.

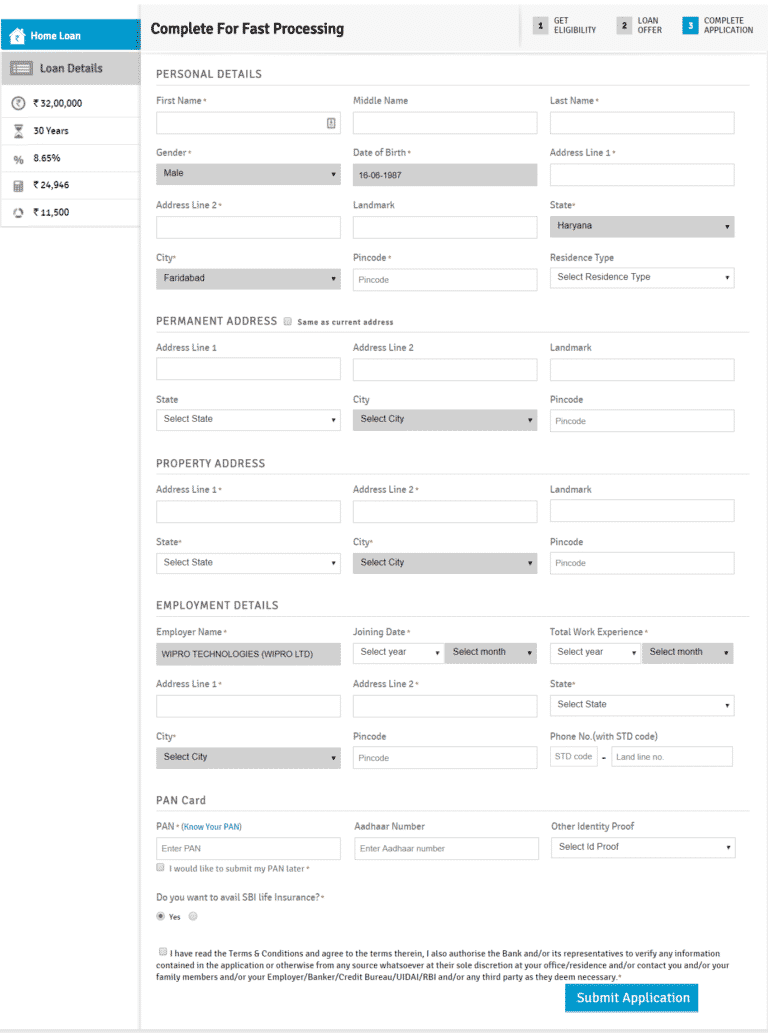

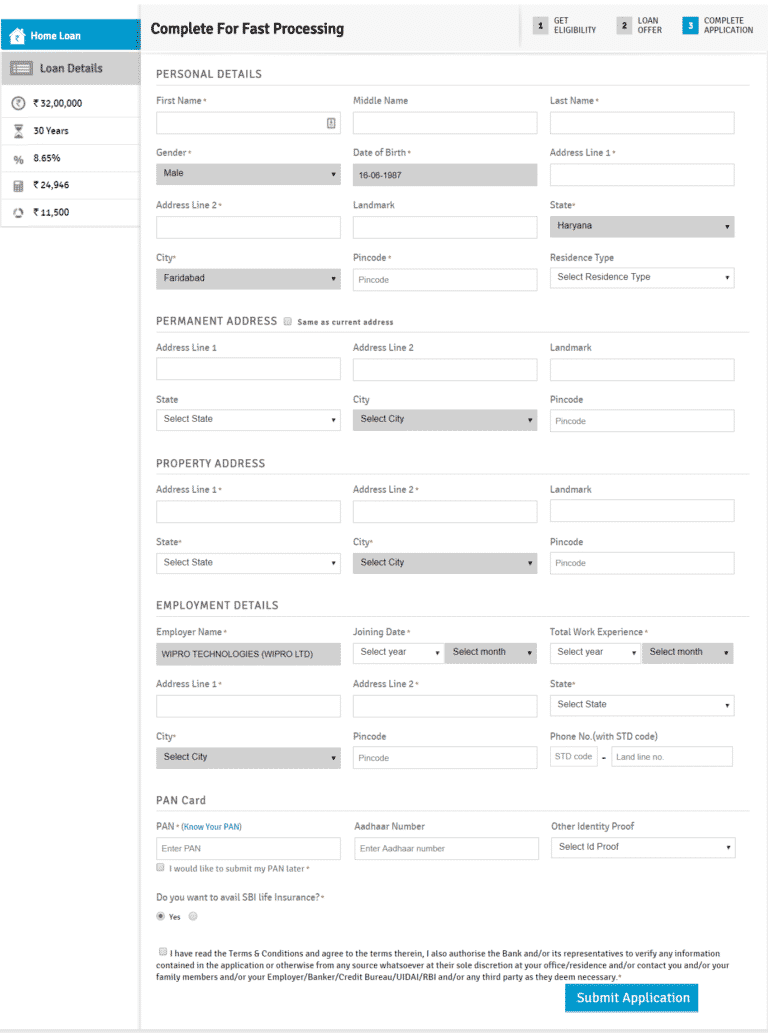

After entering this data into the German mortgage calculator, we calculate the estimated loan amount, interest rate, and monthly repayment rate. Under the Scheme, the interest payable on the Educational Loan for the moratorium period i.e., Course Period plus one year as will be borne by the Government of India. After the period of moratorium, the interest on the outstanding loan amount shall be paid by the student, in accordance with the provisions of the existing Model Educational Loan Scheme of Banks and as may be amended from time to time. You can track the status of your application for Home Loan –PMAY by visiting the SBI Home Loans page where on the SBI-PMAY page, you will find the ‘Application Tracker’ status. You will then have to provide your mobile and reference number to check the status of your application for home loan. Families with annual income between Rs.12,00,001 and Rs.18 lakh can apply for MIG-II scheme.

SBI PMAY Home Loan Eligibility and Guidelines for EWS & LIG

In addition, Apply Online will not be available during downtime. These Terms of Service (Terms & Conditions) and/or the use of services provided through SBI Apply Online services are construed to be governed in accordance with the laws in India. The Bank accepts no liability whatsoever, direct or implied, for non-compliance with the laws of any country other than that of India. The User agrees to abide by prevailing laws in respect of SBI Apply Online services applicable in India.

Overview of SBI PMAY Scheme – All Statutory Those as of Census 2011 and towns identified later will be eligible for MIG coverage under CLSS. This goes on until at the end of the loan, the principal repayments are almost 100% of the monthly annuity. In other words, your savings component increases, month by month, year by year. Depending on the federal state, the property transfer tax is between 3.5% and 6.5% of the purchase price.

Government Schemes

Once, you have the Aadhaar in your name, you can apply for this home loan scheme. Under MIG – II, the maximum loan amount for subsidy is Rs.12 lakh and beneficiaries can avail an interest subsidy of 3%. Under the category, the maximum subsidy amount that can be availed is Rs.2.30 lakh The maximum term of loan on which subsidy will be calculated is 20 years. Applicants who fall under MIG – I category can avail subsidy at the rate of 4% with the maximum loan amount being Rs.9 lakh. The maximum loan term taken into consideration for calculation of subsidy is 20 years. The government launched the ‘Pradhan Mantri Awas Yojana – Housing for All’ scheme with the aim that every Indian household should have a pucca house by 2022.

Under the Economically Weaker Sections or Low Income Group scheme, interest subsidy is offered at a rate of 6.50%. The interest subsidy is offered during the tenure of the loan or for 15 years depending on whichever is lower. The interest subsidy is provided for loans up to Rs.6 lakh with the maximum subsidy amount being Rs.2.20 lakh. Like other banks, State Bank of India is offering interest subsidy on the home loans under the four different categories namely CLSS – EWS / LIG , Revised CLSS – EWS/LIG , CLSS (MIG-I) and CLSS (MIG-II). The subsidy on home loan under the PMAY can be availed by the eligible candidates for acquisition or construction of first home. A customer shall provide such information as the Bank may from time to time reasonably request for the purposes of providing the SBI Apply Online services.

The beneficiary familyshould not own a pucca house(an all-weather dwelling unit) either in his/her name or in the name of any member of his/her family in any part of India. SBI Frequently asked questions , has listed questions and answers, all supposed to be commonly asked in context of Home Loans. Please get answers to your common queries regarding the home loan, security, EMIs, etc. All loan accounts under the Scheme would linked using Aadhaar.

'Personal Information' refers to any information about the applicant obtained by the Bank in connection with the SBI Apply Online services. Loan limits in excess of Rs. 9 and 12 lacs will granted to qualifying borrowers based on the eligibility criteria set under our present Home Loan Scheme, despite the fact that the CLSS interest subvention only accessible up to Rs. 9 or 12 lacs. A married couple with at least one unmarried child is the recipient. An adult earning member, regardless of marital status, may be designated as a separate household and get a subsidy on their own. The CLSS plan is offered to qualified EWS and LIG candidates through 2022, whereas MIG applicants may apply for the interest subsidy under the CLSS scheme until 2022.

Which central nodal agencies are operating the disbursal of subsidy under CLSS? National Housing Bank and Housing and Urban Development Corporation Limited are the central nodal agencies which are operating the disbursal of subsidy under CLSS. Should not have taken a home loan or availed interest subvention benefit under the scheme. The ownership of the house should either be in the name of the female member of a household or in joint ownership with your wife (applicable to EWS/LIG and revised EWS/LIG schemes only). "THE MOST PREFERRED HOME LOAN PROVIDER" voted in AWAAZ Consumer Awards along with the MOST PREFERRED BANK AWARD in a survey conducted by TV 18 in association with AC Nielsen-ORG Marg in 21 cities across India.

Families who are economically weak, do not own a pucca house, and reside in an urban area can apply for this home loan scheme. Under CLSS, the maximum subsidy you can claim is Rs.2.67 lakh. "Upload Document" functionality is provided for expediting the loan process. The Bank may ask for original and/or photo copy of such document for verification and/or at the time of processing of loan application. Bank will not use such document for any other purpose like updating KYC details, etc.

We'll calculate your maximum property budget based on your income, savings, residency status and the criteria of our 750+ partner banks. The more equity or savings you bring in, the lower your loan-to-value ratio LTV and hence the interest rate at which the bank grants you your mortgage. Typically, banks lower the interest rate gradually in 5% steps of the LTV. In other words, a higher down payment means a lower LTV and a lower interest rate, and vice versa, a lower down payment means a higher interest rate due to a higher LTV. To optimize the recommendation engine, we review daily the mortgage products and conditions of over 750 lenders.